4 step Digital Filing Process

Our Process

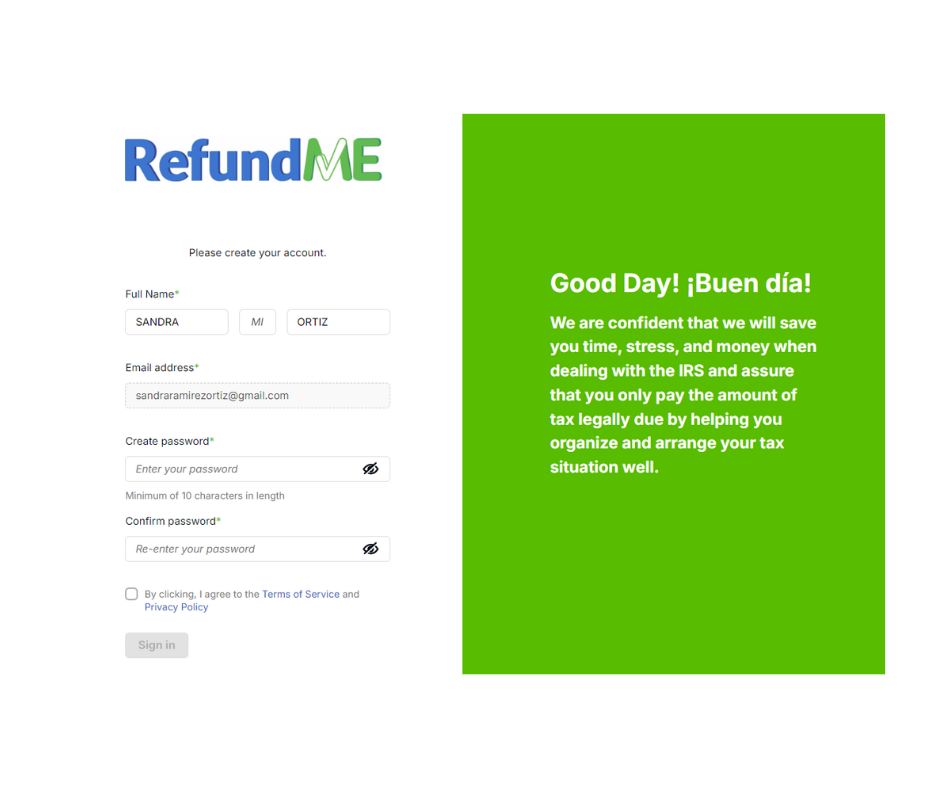

STEP 1

Client Organizer

You create a log-in to our client portal. Complete the client organizer and upload your tax documents to help us understand your tax scenario. Connect with any device using the Client Portal app.

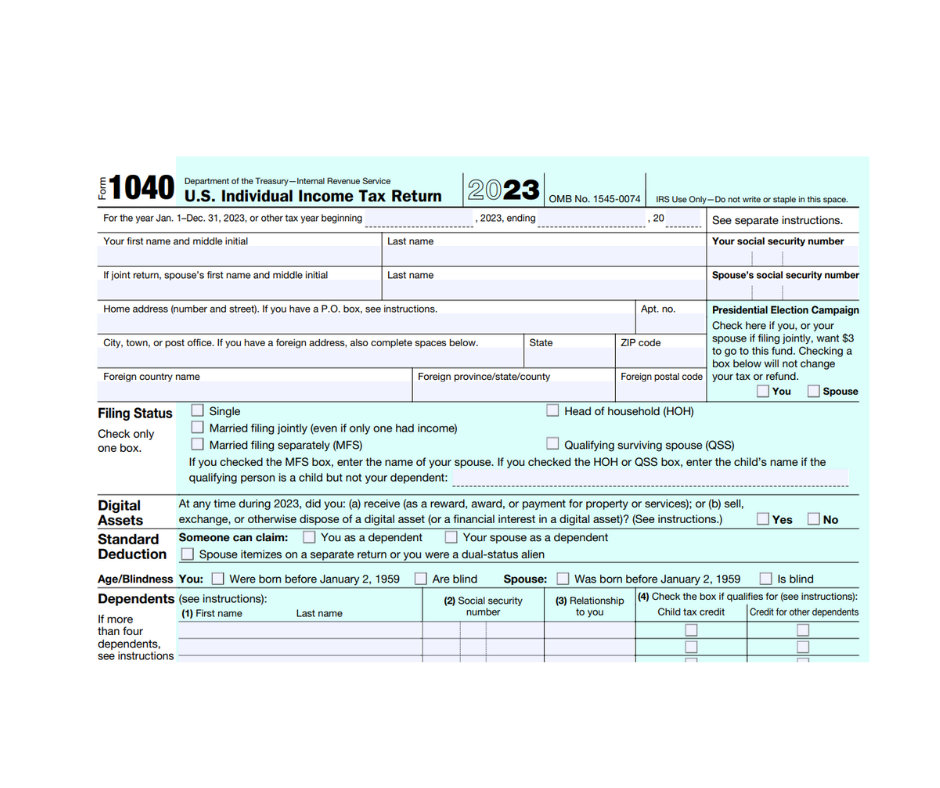

STEP 2

We Do Your Taxes

Once we receive your tax organizer, we do your taxes for you. We upload a draft of your tax return to the client portal for your review. Once you approve, we do a quality control check before e-filing your tax return.

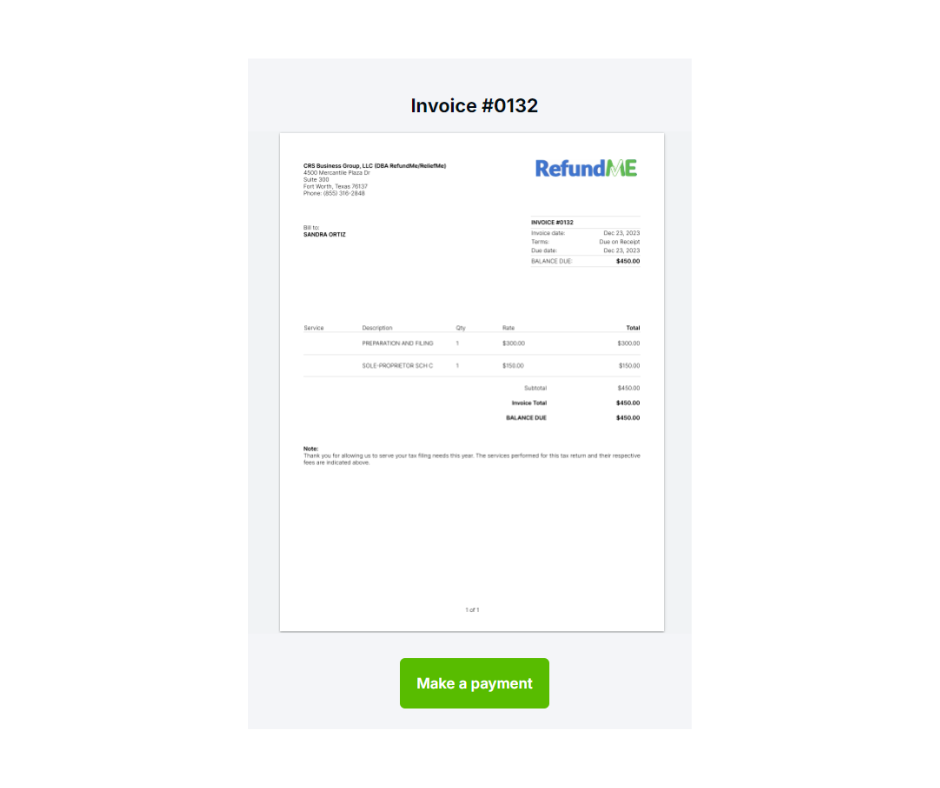

step 3

E-sign and E-pay

You will receive an email requesting for your e-signature and e-payment. Once you e-sign and e-pay, we will proceed with e-filing and you will receive access to your PDF tax return via the client portal.

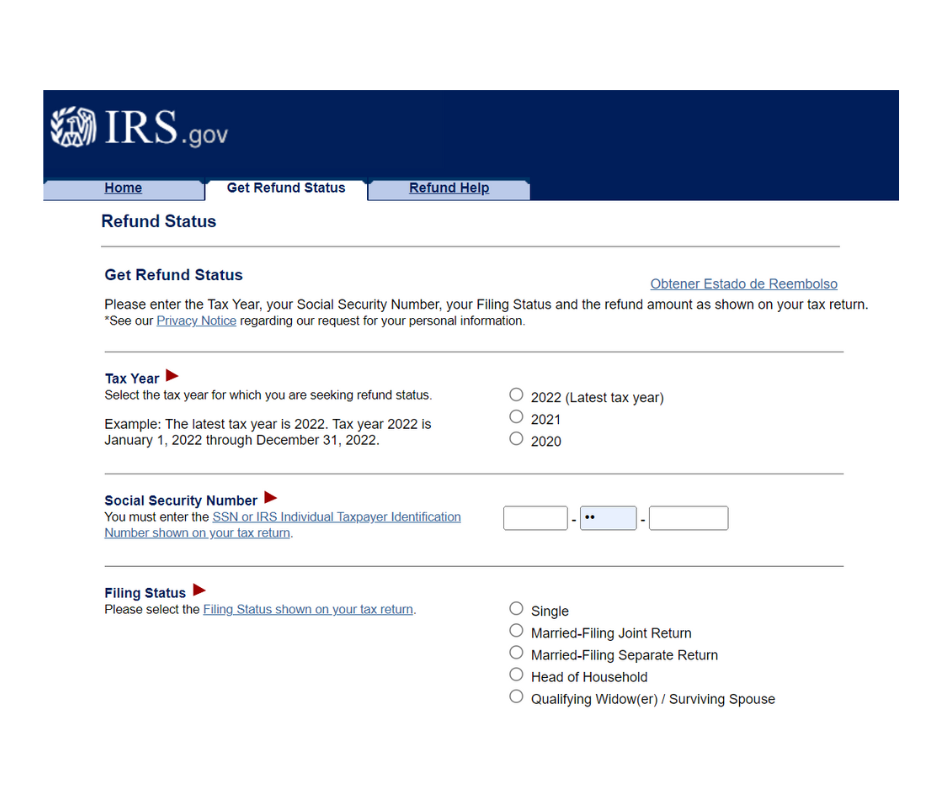

step 4

Refund or Payment

Receive your refund faster with e-file and direct deposit. View your refund status directly at IRS.gov. If you owe the IRS we can discuss your payment options to make sure you remain tax compliant.